Navigating the complex landscape of regulatory compliance is a critical task for businesses aiming to operate within the UK’s stringent legal framework. This article delves into the essential aspects of ensuring that your compliance documents align with UK standards, emphasizing the pivotal role of professional translation services in this process. We will explore key regulatory requirements in the UK financial sector, common translation challenges, and strategies for accurate adaptation. From the necessity of understanding UK compliance to the importance of multilingual support, this guide equips you with the knowledge to select the right service provider and maintain cultural relevance in translated documents. Key considerations for selecting a translation service that guarantees precision and comprehensiveness are highlighted, culminating in a case study showcasing successful compliance document adaptation with professional translation services.

- Understanding the Necessity of UK Regulatory Compliance for Businesses

- Identifying the Key Regulatory Requirements in the UK Financial Sector

- The Role of Professional Translation Services in Regulatory Compliance

- Common Challenges in Translating Regulatory Documents for UK Markets

- Steps to Adapt Your Compliance Documents for the UK Legal Framework

- The Importance of Multilingual Support in Navigating UK Regulations

- Key Considerations When Selecting a Translation Service Provider for Compliance Documents

- Ensuring Accuracy and Cultural Relevance in Translated UK Compliance Documents

- Case Study: Successful Adaptation of Compliance Documents with Professional Translation Services

Understanding the Necessity of UK Regulatory Compliance for Businesses

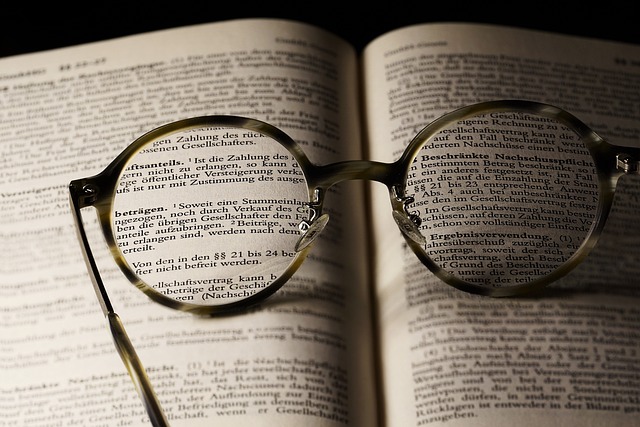

For businesses operating in or planning to enter the UK market, ensuring compliance with local regulations is paramount. The UK’s regulatory environment is distinct, with its own set of rules and standards that must be adhered to. This includes a comprehensive understanding of legislative requirements specific to the UK, which often differ from those in other countries. To navigate this complex landscape effectively, translation services for UK regulatory compliance documents play an indispensable role. These services bridge the gap between international businesses and the UK’s regulatory framework by accurately translating documentation, ensuring that all legal and administrative content is precisely conveyed in the English language. This precision is crucial for businesses to communicate with UK regulators, comply with statutory obligations, and operate within the legal boundaries set forth. Moreover, utilising professional translation services not only safeguards against misunderstandings and legal non-compliance but also demonstrates a commitment to transparency and due diligence, which are highly valued by UK authorities and consumers alike. In the UK, the stakes for regulatory compliance are high, with severe penalties for non-compliance. Therefore, businesses must take proactive steps to ensure that all documentation is not only accurately translated but also meticulously tailored to align with UK regulations. This due diligence not only minimises legal risks but also fosters a foundation of trust and credibility in the UK market.

Identifying the Key Regulatory Requirements in the UK Financial Sector

As businesses expand their operations, ensuring compliance with the specific regulatory framework of the United Kingdom’s financial sector is paramount. The UK’s regulatory environment is characterised by a comprehensive set of rules and standards administered by various bodies, including but not limited to the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA). These entities enforce regulations that govern financial markets, consumer protection, anti-money laundering measures, and conduct oversight. For companies operating within or seeking entry into the UK market, translation services for UK regulatory compliance documents are essential. These services facilitate a clear understanding of the requirements, such as the FCA’s Handbook, which details the rules, guidance, and decision-making processes impacting firms. Additionally, post-Brexit, the UK has established its own regulatory framework separate from the European Union, necessitating a thorough review and adaptation of compliance documentation. Utilising expert translation services ensures that all regulatory texts are accurately conveyed, enabling businesses to navigate the UK financial sector’s intricate regulatory landscape with confidence and in full compliance with the applicable legal standards. This meticulous attention to detail and adherence to UK-specific regulations not only safeguards firms from potential legal penalties but also fosters trust among clients and stakeholders, which is a cornerstone of successful financial operations within the UK.

The Role of Professional Translation Services in Regulatory Compliance

Navigating UK regulatory compliance can be a complex task, especially for entities operating in a multilingual environment. Ensuring that all documentation is accurately translated to meet local legal standards is paramount. Professional translation services play a pivotal role in this process. These experts not only convert text from one language to another but also adapt content to align with the specific regulations and cultural nuances of the UK market. Utilizing specialized translation services for UK regulatory compliance documents safeguards against misinterpretation and legal non-compliance, ensuring that all communications are clear, precise, and legally sound within the British jurisdiction. By leveraging the expertise of these professionals, companies can confidently present documentation to UK authorities, secure in the knowledge that their translated materials have been meticulously crafted to adhere to the stringent requirements set forth by UK law. This diligence not only facilitates smooth operational processes but also upholds the integrity and reputation of the company within the UK regulatory framework.

Common Challenges in Translating Regulatory Documents for UK Markets

Steps to Adapt Your Compliance Documents for the UK Legal Framework